Higher tax for those earning more than £70,000, what are the facts?

Higher tax for those earning more than £70,000, what are the facts?Article

It’s been a little over two days since the Prime Minister, Theresa May, announced a snap general election. But already the parties have begun to set out their stalls for the coming debate.

In a contest that will inevitably be dominated by the Brexit negotiations, the Opposition have shown an intent to push the discussion back to the domestic economy, and to the question of fairness in particular.

Yesterday, the Shadow Chancellor, John McDonnell, said the election should not focus on Brexit, but on an economy that is about to take a turn for the worse. He also appeared to make a specific announcement on tax: arguing that ‘the rich [need to] pay their way more’, and in particular those earning ‘above £70,000 to £80,000 a year’.

What are the facts?

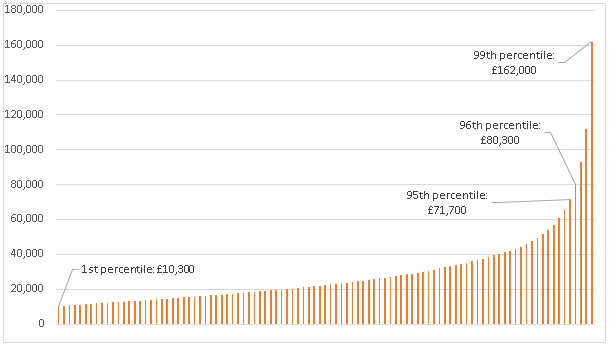

In 2014/15, people with pre-tax incomes above £70,000 were among the richest 5 per cent of individuals in the country, with the richest 1 per cent enjoying incomes in excess of £160,000 – although it is worth bearing in mind that the highest income individuals will not always live in the highest income households.

The income tax system is already highly reliant on high earners. HMRC estimate that the top 5 per cent in 2016/17 will have paid more than 47 per cent of all income tax, with the top 1 per cent contributing just under 27 per cent. This is not true of the tax base overall, however, with taxes such as VAT and National Insurance being much less skewed to high earners; indeed, in the case of VAT being actually regressive (ie less than proportional to income).

Asking those earning over £70-80,000 to pay more in income tax may be justified from the point of view of fairness, or considered necessary to raise revenue for services such as health and social care. But it also makes income tax receipts less certain from year-to-year over the longer term, since revenue will be proportionately more exposed to the fortunes of a relatively small section of the population.

Distribution of pre-tax incomes from poorest to richest, 2014/15

Source: HMRC

If a Chancellor wanted to do this, how could it be done?

For 2017/18, the ‘higher rate’ of tax at 40 per cent is currently applied to people earning above £45,000 per year. The ‘additional rate’ of 45 per cent is applied to incomes over £150,000.

Using the IPPR tax-benefit model, we have tested how the existing income tax schedule could be adjusted to reflect the Shadow Chancellor’s announcement.

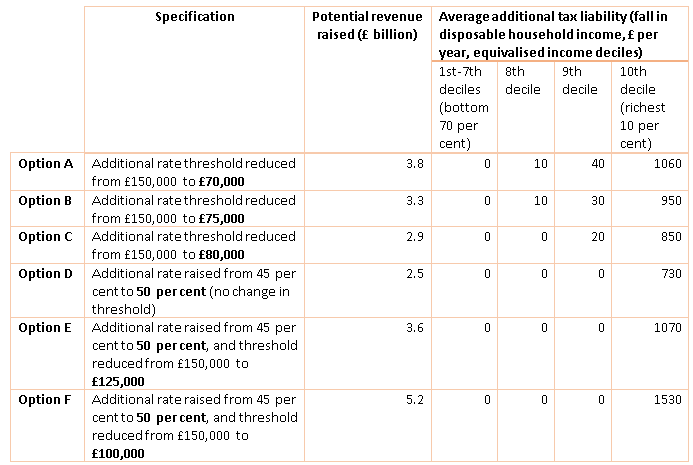

We have modelled six illustrative reforms to the additional rate. Three reduce the threshold for the additional rate of tax: from £150,000 to £70,000, £75,000 and £80,000 respectively. Three more would raise similar amounts of money but would target the rises on people on incomes well above £70-80,000. These would raise the additional rate from 45 per cent to 50 per cent: the first keeping the threshold at £150,000, the second lowering it to £125,000 and the third to £100,000. Our full results are set out in the table below.

A static simulation of these different schemes suggests they would raise between around £2.5 and £5.2 billion a year in 2017/18, with the burden of taxation falling almost entirely on the richest 10 per cent by household disposable income, after adjusting for family size. They would in practice also represent only a small shift in the burden of taxation, with the share of income tax paid by the richest 5 percent of individuals rising from around 47 to 48 per cent.

These figures, however, do not take account of any behavioural change that may be induced by a higher tax rate. The true scale of any behavioural response is difficult to estimate with any certainty, with the UK’s recent experience of changing tax rates offering only partial answers at best.

The rise in the additional rate to 50 per cent in 2010/11 proved only temporary (falling back to 45 per cent in 2013/14), and crucially people were given forewarning of both the rise and the fall. This meant that high earners could optimise their tax liabilities by shifting incomes – especially from dividends – between years in order to avoid the higher rate.

The Office for Budget Responsibility (OBR) has estimated that lowering the higher rate from 50 to 45 per cent may have cost the government only £100 million in 2013/14, due to people moving their incomes from one year to the next. But the OBR also concluded that ‘the extent of the income-shifting prompted by the preannouncement means it will never be possible to estimate the true cost of reducing the rate with any confidence’. Similar uncertainties also exist for raising the additional rate back to 50 per cent, or lowering the threshold to include those earning £70,000 to £80,000.

In the first few years of a new tax regime, income shifting will almost certainly result in less revenue being raised than the full potential. But if the tax remains permanent, the estimates below are likely to be more robust over the medium to longer term, albeit subject to fluctuations in employment and pay.

Indeed, our estimates could even prove overly conservative. Income from dividends and savings are typically underreported in the survey data, leading to the calculation of potential revenue raised being artificially low, especially from higher earners.

It is not yet clear if the Shadow Chancellor’s remarks will make their way into the Labour manifesto. But if they do, past experience suggests that taxation will quickly become one of the principal battlegrounds of the election. It will be as well in that case for voters to be armed with the facts.

Illustrative changes to the Additional Rate of income tax, 2017/18

Source: IPPR tax benefit model using data from three years of the Family Resources Survey (2012/13 to 2014/15), and uprated using ONS (various datasets) and the OBR’s Economic and Fiscal Outlook (various years).

Note: All figures denote the difference between a respective reform and a baseline scenario designed to reflect the present income tax regime in 2017/18. Figures are net of any changes in benefit entitlement and income. The IPPR tax-benefit model is a micro-founded model that estimates the impact of policy reforms prior to any behavioural effects

.

Related items

Towards a fair and proportional property tax

In search of the Scottish economy's 'low-hanging fruit': IPPR Scotland responds to the Muscatelli report

The report is a serious and thoughtful analysis of what is and isn’t working in Scotland’s economic development eco-system.

Celebrating 10 years of IPPR Scotland

In celebration of our 10th anniversary, IPPR Scotland was delighted to host a daylong conference on October 29.