UK industrial strategy, redux: Reinvention or return to the 1970s?

Article

Since the 2008 global financial crisis, ‘industrial strategy’ has been firmly back on the UK political agenda. The coalition government promised to regenerate manufacturing via George Osborne’s ‘march of the makers’ and to ‘rebalance the economy’ both in terms of lessening the country’s dependence on financial services and reinvigorating major city regions through initiatives such as the ‘northern powerhouse’. With the result of the June 2016 EU referendum and the start of our journey towards Brexit came Theresa May’s commitment to producing a ‘match fit’ economy able to thrive in the post-EU era. That intention was made plain with a significant renaming of the government’s Business, Innovation and Skills department as the Department for Business, Energy and Industrial Strategy.

But what exactly is an industrial strategy? What has been our past experience of such policy? And what historical lessons might be useful for the future?

THE LONG HISTORY OF UK INDUSTRIAL POLICY

For much of the past century, governments have attempted to shape the country’s industrial (and to a lesser extent commercial) landscape. Nevertheless, while ‘industrial policy’ and ‘regional policy’ have often been in evidence, the crafting of a coherent industrial strategy has been a rarer event. Moreover, although for over a century governments have been concerned about the need to raise the efficiency and competitiveness of British industry, historically there has been little consensus on how best to do it.[1] Often the focus has been on maintaining employment in areas affected by the decline of what were once known as the ‘staple’ industries, including textiles and shipbuilding. Indeed, Britain can plausibly lay claim to the invention of regional policy in the 1930s and, with the notable exception of the Thatcher era, it has been a regular feature of UK government.[2] In this regard rebalancing the economy in the geographical sense has been with us for a long time.

More generally, the government has, since the 1940s, attempted to stimulate industrial (and commercial) investment via the tax system and sometimes through direct grants, often overlapping this with regional policy. Likewise, attempts to raise productivity were a feature of the postwar years (initially via the Anglo-American Council on Productivity, which tried to inculcate in UK industry lessons learned from US firms with significantly higher productivity).[3] From 1948, when the Monopolies and Mergers Commission was established, we also see a reasonably persistent desire to raise efficiency by exposing British firms to more competition. Until the start of the 1960s, however, these policies were implemented in the absence of a coherent overarching strategy.

In 1961, treasury officials produced for the chancellor, and subsequently for the cabinet, the first authoritative attempt by the British government to analyse the sources of and barriers to economic growth and set out a strategy to raise productivity, growth and living standards.[4] It identified a role for government in raising the level and quality of private investment, improving the quality and mobility of the workforce, raising the quality of management, sustaining employment in areas of declining industry in a sustainable way that would not need long-term subsidy, bearing down on anti-competitive practices in business and on restrictive labour practices, putting businesses under pressure by reducing tariffs, and ensuring that decisions on public expenditure and taxation were taken with a view to creating ‘an efficient full-employment economy capable of sustained growth’.[5] This forgotten document was the wellspring of two decades of industrial interventionism.

This wide-ranging programme was given force first by the Macmillan government’s creation of the National Economic Development Council (NEDC), its staff (the National Economic Development Office) and subordinate industry-level development councils, and then by the publication by the NEDC of its own analysis (which owed much to that of the treasury) and programme for faster growth. This inaugurated the era of ‘indicative planning’ whereby government consulted with employers and unions in a process that set (with clear prime ministerial endorsement) an overall annual growth target of 4 per cent, which the government undertook to assume in its fiscal planning, and set targets for growth and investment in specific industrial sectors. This ‘dash for growth’ was also underpinned by Macmillan’s decision to seek membership of the European Economic Community (approved by the treasury not just for its large tariff-free market into which British firms could sell but as a means of exposing firms to more efficient continental competitors and force them to become more efficient or die).

The involvement of the unions in the NEDC programme was the first sign of drift from the treasury’s original prescription, which had assumed a productive relationship between government and employers only (the involvement of the unions being judged essential as a means of ensuring higher growth and full employment did not feed into wage-push inflation). Another sign of drift was the growing emphasis on regional policy, which drew partly on new academic ideas about the promotion of ‘growth poles’ but also on a political calculation by Labour after 1964 that it would thereby sustain support in its electoral heartlands. Policy drifted further away from the treasury’s initial conception of government intervention to sustain a vibrant and competitive private sector economy with initiatives such as Labour’s 1965 National Plan and the promotion by a new Industrial Reorganisation Commission of company mergers to attain economies of scale.[6]

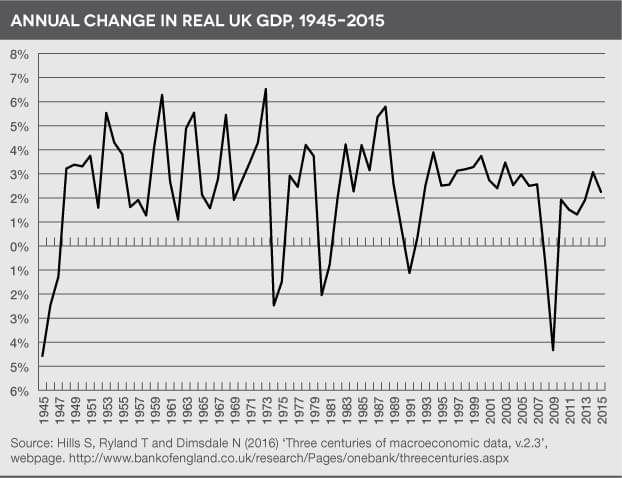

Industrial strategy thus evolved during the 1960s. How successful was it? As can be seen in figure 1, the 4 per cent annual growth target set in 1962 was rapidly achieved but proved unsustainable as the balance of payments worsened due to unmet demand in the domestic economy; sterling weakened and, in a fixed exchange rate regime, currency stabilisation became the overriding priority. The treasury for one came to view the experience very negatively. It bitterly regretted that growth had failed to reach the long-term 4 per cent per annum target even though it had fulfilled its side of the NEDC ‘indicative planning’ bargain by raising the level of physical and human capital formation by government (for example, via the motorway building programme, constructing an entirely new national gas supply network, greater investment in nuclear power generation, railway modernisation, investment in schools and further education colleges and a significant expansion of university education). Other initiatives taken, such as the 1964 training levy-grant system to finance more and better apprentice training, the taxation of short-term capital gains as a means of incentivising long-term investment, and legislation (for example, on redundancy payments) to promote labour mobility seemed also to have failed to raise productivity as much as the treasury had hoped. Regional policy had a mixed record: its most notable successes were in moving government jobs out of London (for example, the administration of national insurance to Newcastle, and of driver and vehicle licensing to Swansea), but much of the incentivisation of regional industrial investment (such as in the automotive sector) failed to be sustainable over the long-term. The most successful area of regional industrial intervention actually flowed from military procurement, long targeted at peripheral areas, and this reflected the importance of what David Edgerton termed Britain’s postwar ‘warfare state’ in promoting technological development and manufacturing.[7]

Figure 1

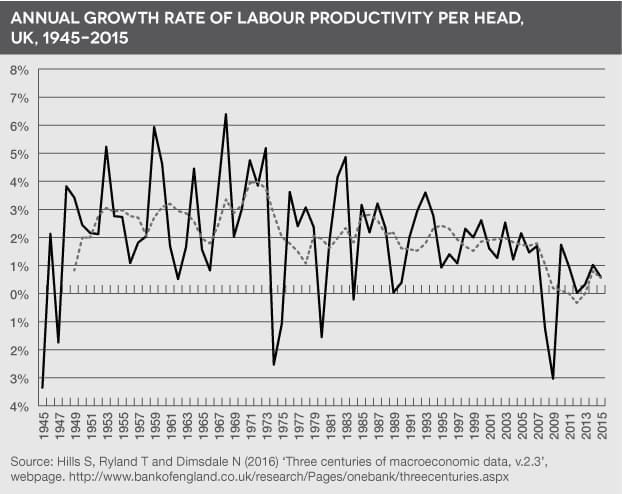

Figure 2

Nonetheless, the overall record was much better than is often assumed. The average annual growth of GDP was raised from an average of 3 per cent to 3.6 per cent between 1962 and 1973 and real GDP per capita by the end of that period had risen by 45 per cent (of which about 5 percentage points reflected the higher annual growth rate). That was an achievement. Moreover, the 1960s also saw a notable rise in labour productivity, as is evident in figure 2. At the start of the decade it was growing by 2.6 per cent a year; by 1967 the annual growth rate was 6.4 per cent – a peak then followed by a fairly consistent decline to the present day.

The global economic crisis and the onset of Britain’s first postwar recession in 1973 coupled with the onset of ‘stagflation’ represented a considerable challenge for industrial strategy. Increasingly it became defensive – the Heath government’s promise to leave ‘lame ducks’ in industry to their fate proved short-lived. Some of that was judicious and pragmatic – most notably the decision to save Rolls-Royce from bankruptcy. Despite Labour’s embrace of an ‘alternative economic strategy’ in the 1970s and early 1980s, which envisaged a substantial increase in public ownership and control of industry, little of this was actually implemented after 1974.[8] Instead, industrial policy in the 1970s was on the whole more about maintaining employment via subsidies than improving economic vitality. Understandable as that was, it opened the way for industrial strategy to be effectively junked by the Thatcher governments of the 1980s.

Yet the industrial strategy of the 1960s and 1970s had a lengthy after-life, for much of the growth in succeeding decades was built upon it. We are still driving on the motorways of that era, many of us travel on its high-speed trains, we power and heat homes, offices and factories using utility networks that have at their heart the infrastructure of that era, and many of us benefited from its investments in education and training.

THE PRESENT AND FUTURE OF UK INDUSTRIAL STRATEGY

What is industrial strategy in the post-financial crisis, post-Brexit referendum world? In 2012, the then Department for Business, Innovation and Skills (BIS) noted that UK ‘industrial policy’, such as it was, had shifted since 1979 to focus on ‘horizontal’ encouragement of foreign investment, competition promotion and market liberalisation. Little of the earlier sectoral focus remained (save perhaps in the automotive and aerospace sectors), not least because that earlier conception of industrial policy had been judged to be ‘ineffective at improving the long-term viability of the UK’s industrial base’.[9] BIS’s then industrial strategy was based on several key principles: a focus on building long-term sustainable growth, open and competitive markets as the means to stimulate innovation and growth, identifying ‘high value opportunities’ based on the country’s key strengths and capabilities (and putting government money towards capitalising on them), and building ‘a collaborative but challenging strategic partnership with industry to ensure appropriate government intervention which delivers the desired market outcomes’.[10] The commitment to additional government expenditure on human and physical capital formation was relatively insignificant and there was little there that differed from the approach of the preceding quarter of a century (as with New Labour, old tunes were being played on new instruments).[11]

What does the post-referendum emphasis on industrial strategy amount to? Though the rhetoric of reinvention and reinvigoration is loud so far, it is hard to see what has changed. The promises made to Nissan to allay its concerns about Brexit and keep it in Sunderland (and, one suspects, similar promises made to Tata to encourage its expansion of Jaguar Land Rover) are more reminiscent of 1970s-style ad hoc job preservation than they are of a coherent overarching industrial strategy on the lines of the 1960s. As Craig Berry has pointed out, there is little evidence yet of coherent thinking or of institutions working together within an overarching programme for the retooling of a more productive economy.[12] Crucially, it is far from clear that the treasury is signed up to such a strategy, and so far its commitments on rebuilding national infrastructure over and above existing (relatively small) commitments made since the creation of the National Infrastructure Plan in 2010 are notably slight, and the hoped-for private sector investment has largely failed to materialise.

Does the past hold any lessons for present-day proponents of an industrial strategy? It is easy to dismiss a century or so of ‘industrial policy’ as a self-evident failure given UK manufacturing is now ‘a pale shadow of its former self’.[13] Likewise, it is notable that there has been relatively little change in the regions seen as underperforming. That suggests a need for some caution both about the potential of traditional-style ‘regional policy’ and about the scope to reinvent Britain as ‘an industrial nation’.

That said, let’s remember that government interventionism in the 1960s had its successes. The achievements of that decade flowed from the conscious creation of an interlinked and wide-ranging strategy that went well beyond promoting the growth of manufacturing. That strategy was underpinned by a clear and long-term government commitment (supported by the treasury and prime minister) to spend money not just on physical investment but on instilling confidence in private companies that additional investment by them would be worthwhile (what the government’s then chief economic adviser Alec Cairncross called the ‘trick of confidence’) and on better education and training. On that score, the recent recognition by the OECD’s chief economist that ‘fiscal initiatives could catalyse private economic activity’ and enable us to ‘exit the low-growth trap’ [14] is welcome. The barrier to implanting such an approach in the UK is that we remain essentially trapped in the ‘austerity’ rhetoric of 2010–15. Here, perhaps the most important lesson of the 1960s is that well-targeted government infrastructure spending purchases productive assets with long-term growth potential – and we would realise this if only we could reconceptualise national accounting to embrace a national balance sheet as well as an annual government profit and loss account.

Hugh Pemberton is reader in contemporary British history at the University of Bristol.

Footnotes

[1] Tomlinson J (1994) Government and the Enterprise since 1900, Clarendon Press. [<<back]

[2] Gill SF (2005) ‘A New Regional Policy for Britain’, Regional Studies 39(5): 659–67. [<<back]

[3] Carew A (1991) ‘The Anglo-American Council on Productivity (1948–52): The Ideological Roots of the Post-War Debate on Productivity in Britain’, Journal of Contemporary History 26(1): 49–68. [<<back]

[4] Lloyd S (1961) ‘Economic Growth and National Efficiency’, memorandum, paragraph 98. http://discovery.nationalarchives.gov.uk/details/r/D7659293. [<<back]

[5] Pemberton H (2004) Policy Learning and British Governance in the 1960s, Palgrave Macmillan. [<<back]

[6] O’Hara G (2007) From Dreams to Disillusionment: Economic and Social Planning in 1960s Britain, Palgrave Macmillan. [<<back]

[7] Edgerton D (2005) Warfare State: Britain, 1920–1970, Cambridge University Press. [<<back]

[8] Wickham-Jones M (1996) Economic Strategy and the Labour Party: Politics and Policy-Making, 1970–83, Macmillan. [<<back]

[9] Department for Business, Innovation and Skills (2012) 'Industrial Strategy: UK Sector Analysis', BIS economics paper no 18. [<<back]

[10] Ibid. [<<back]

[11] Beath J (2002) ‘UK Industrial Policy: Old Tunes on New Instruments?’, Oxford Review of Economic Policy 18(2): 221–239. [<<back]

[12] Berry C (2016) ‘Britain’s “radically redundant” industrial policy will not halt manufacturing decline’, blog post, LSE British Politics and Policy blog, 25 November 2016. http://blogs.lse.ac.uk/politicsandpolicy/. [<<back]

[13] Chang H-J, Andreoni A and Kuan ML (2013) ‘International Industrial Policy Experiences and the Lessons for the UK’, Government Office for Science, Future of Manufacturing Project evidence paper 4. [<<back]

[14] Mann C L (2016) ‘Deploy effective fiscal initiatives and promote inclusive trade policies to escape from the low-growth trap’, blog post, OECD Ecoscope, 28 November 2016. https://oecdecoscope.wordpress.com. It is worth remembering, too, that if public spending for growth succeeds then it has the potential to lower UK public debt as a proportion of its GDP (as it did in the 1960s and 1970s, when it fell from 103 per cent to 45 per cent). [<<back]

Related items

Rule of the market: How to lower UK borrowing costs

The UK is paying a premium on its borrowing costs that ‘economic fundamentals’, such as the sustainability of its public finances, cannot fully explain.

Restoring security: Understanding the effects of removing the two-child limit across the UK

The government’s decision to lift the two-child limit marks one of the most significant changes to the social security system in a decade.

Building a healthier, wealthier Britain: Launching the IPPR Centre for Health and Prosperity

Following the success of our Commission on Health and Prosperity, IPPR is excited to launch the Centre for Health and Prosperity.