Cut council tax for vast majority by raising top three tax bands, recommends IPPR

14 Nov 2025Press Story

- Property tax reform would raise £3 billion while making the system fairer and more progressive

- Four out of five households would see their council tax fall by an average of 3 per cent

- Only the top 10 per cent of homes would see their council tax increase

The Institute for Public Policy Research (IPPR) has today set out a plan for property tax reform that would cut council tax bills for four in five households while making the system fairer and raising revenue to fund vital public services.

The current council tax system is outdated and regressive, with those in lower-value homes paying far more, proportionally, than those in the most expensive properties, say the authors of the research. For instance, a property in Kensington today pays less council tax than one in Blackpool. These reforms would make council tax fairer, reflecting the principle that those who have gained most from rising property wealth contribute more.

The think tank says that, in the long term, Britain should move towards a Proportional Property Tax (PPT), linking tax liability directly to property value and creating a fairer, more efficient system.

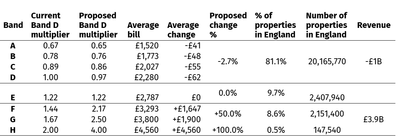

In the short term, IPPR suggests raising tax on bands F and G by 50 per cent and on the top band H (homes likely to be worth more than £1.5 million today) by 100 per cent, to raise £3.9 billion.

Around £1 billion of this revenue should be used to cut council tax bills for the lower bands A to D. This would give an average saving of £45 to 80 per cent of households.

Bands F to H correspond to homes worth over £120,000 in 1991, likely to be worth over £600,000 today. These are concentrated in London and the South East.

However, IPPR says in its paper published today that to maintain fairness, asset-rich but cash-poor households should be able to defer or smooth payments.

Alongside this, IPPR proposes a rise in the non-resident buyer surcharge – from 2 per cent to 6 per cent – to deter speculation in the housing market and make the system fairer. This should be combined with incentives for non-resident investors to move to and work in the UK.

The UK has a distinct problem with overseas buyers using UK homes as a store of value but contributing little further investment to the UK economy other than driving up house prices.

The think tank says this “anti-speculation tax” would be a popular and symbolic measure, following examples in Canada where such policies have helped cool overheated markets and supported resident first-time buyers.

Aditi Sriram, economist at IPPR and lead author of the IPPR paper, said:

“The current council tax system is unfair, inefficient, and long past its sell-by date. Our proposal cuts bills for the vast majority of households while asking those with the greatest property wealth to pay a fairer share. It’s a reform that supports working families, strengthens local services, and lays the foundations for a fairer tax system.”

Carsten Jung, associate director for economic policy at IPPR, said:

“This reform can be a first step towards taxing property in a more balanced way. Millions of families would see a small decline in their bills – especially in less prosperous parts of the country – with more to come if the government go for further reform. This is exactly the kind of policy we should expect from a government relentlessly focussed on reducing the cost of living.”

ENDS

Aditi Sriram and Carsten Jung, the blog’s authors are available for interview

CONTACT

David Wastell, director of news and communications: 07921 403651 d.wastell@ippr.org

Rosie Okumbe, digital and media officer: 07825 185421 r.okumbe@ippr.org

NOTES TO EDITORS

The IPPR paper, Towards a fair and proportional property tax, by Aditi Sriram and Carsten Jung, was published at 0001 on Friday November 14 and is available at https://www.ippr.org/articles/towards-a-fair-and-proportional-property-tax

TABLE: Council tax bands and proposed changes in England

Revenue estimates are based on the number of households in each council tax band and region in England, using the 2024-25 average council tax bill of £2,280. The total raised from increasing rates on higher bands uses the IFS estimate that a 50 per cent rise on bands F-G would raise around £3.5 billion. Additional revenue from doubling band H was calculated using the Tax Policy Associates council tax reform calculator, to produce the total figure cited. Estimates of misbanded properties draw on IFS analysis on percentage of homes which are incorrectly valued, equivalent to roughly 10,000 households. The revenue impact of raising the foreign buyer surcharge is based on around £120 million raised annually since 2021 at 2 per cent and assuming high elasticity.