‘Double whammy’ budget for Holyrood: UK Government benefits cuts could leave poorest in Scotland hundreds of pounds worse off

15 Dec 2015Press Story

- Poorest households hit with £580 yearly cut, while of those facing benefits cuts, average households will be over £800 worse off

- Non-protected departments in Scotland could see spending fall by 10.7% by 2020 (cumulative, real-terms) - worth around £1.5 billion per year in 2020

- Next year (2016/17), non-protected departments in Scotland could see spending fall by 2.9% - worth over £400m in real terms (just under £200m in cash-terms)

Many of the poorest households in Scotland could lose out significantly because of the Chancellor’s income tax and benefit decisions, while the richest third in Scotland look set to gain, according to new analysis by IPPR Scotland.

In the week that the Scottish Government’s draft budget (this Wednesday, December 16) is announced, IPPR Scotland’s new analysis looks at the impacts in Scotland of the UK Government’s spending decisions in the Summer Budget and last month’s Autumn Statement and Spending Review.

The analysis finds that to reverse these benefit cuts in Scotland would cost around £500m per year by 2020 (in real terms). The analysis also shows that in terms of public spending, non-protected departments in Scotland could see cuts of 2.9% next year (2016/17) worth over £400m (just under £200m in cash terms), and cuts of over a tenth by 2020 (real-terms, cumulative) a reduction of around £1.5b per year by the year 2020.

This means the poorest households in Scotland could be facing a double whammy of benefit cuts and public spending cuts.

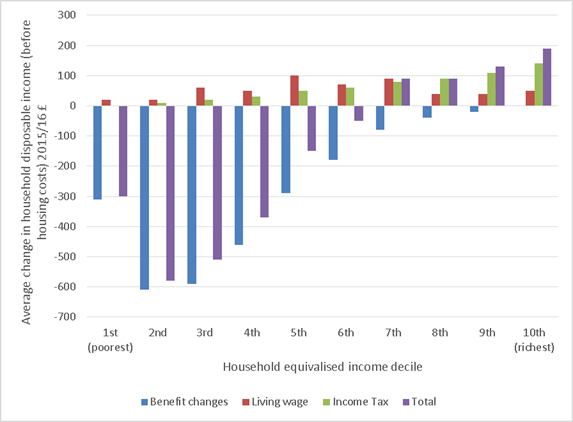

The tax, benefit and ‘Living Wage’ analysis has found that by 2020:

- The poorest third of households in Scotland will see significant losses from the effects of benefit cuts, even after taking account of the increased personal allowance and increased minimum wage (or ‘living wage’). The richest third will benefit from these changes. Overall the bottom 60% of households will lose out.

- Despite the abandoning of plans to cut tax credits, benefits cuts will still be significant by the year 2020.

- The 2nd and 3rd poorest deciles will be the hardest hit with a £580 and £510 net loss respectively, once the effects of benefits cuts, tax changes, and the announcement of the ‘living wage’ are combined. Of those that see benefit cuts, the average loss is over £800 per year by 2020.

- The toughest benefit cuts will come later in this parliament, with benefit changes seeing around £500m per year cut from benefit claimants in Scotland by 2020.

The analysis for departmental budgets in Scotland found that:

- The overall cut to Scotland’s budget, over the next four years, is likely to be around 3.9% by 2020 (cumulative in real terms). Increased income from Business Rates, as Scotland’s economy grows, may reduce this to 2.7%.

- However, taking into account announcements to increase Scottish NHS spending, childcare and affordable housing, non-protected departments in Scotland could see spending fall by 10.7% by 2020 (cumulative, real-terms), worth around £1.5 billion per year in 2020 (real terms).

- Next year (2016/17) non-protected departments could see cuts of 2.9%, worth over £400m in real-terms (just under £200m in cash-terms).

- Cuts are most significant to Scotland’s overall budget in 2017/18 and 2018/19 (year two and year three).

With the publication of the Scottish Government’s draft budget, we will begin to see how the Scottish Parliament chooses to respond. Over the coming years the Scottish Parliament will need to decide whether to either raise tax revenues to mitigate or eliminate benefit cuts and spending cuts, or to decide where the spending cuts will be passed on to (see Notes to Editors).

Russell Gunson, Director of IPPR Scotland, said:

“The poorest households in Scotland are facing a double whammy of cuts to benefits and potential cuts to public services in Scotland.

“Despite the headlines on the day of the UK Spending Review welcoming the scrapping of proposed cuts to Tax Credits across the UK, we can see that this was more about cuts delayed, rather than cuts avoided. By 2020, many thousands of the poorest households in Scotland will see their incomes drop by hundreds of pounds each year, while the richest households in Scotland will benefit through tax cuts.

“At the same time, the UK Government’s spending decisions will see significant cuts to spending on public services in Scotland. Our calculations show that, for Scotland, departments outside of health, affordable housing, and childcare could see cuts of over a tenth, leaving a shortfall of around £1.5billion per year by 2020. From April next year, these non-protected departments could be facing cuts of over £400m in real-terms.

“As the Scottish Government prepares to outline Scotland’s draft budget later this week, they will be carefully considering options for how the significant spending cuts facing Scotland could be reduced, and how the impact of benefits cuts facing families across Scotland could be lessened. It is clear that the UK’s spending cuts will bring serious cuts to Scotland. How these cuts are reduced in Scotland or where they are passed on will require some incredibly difficult choices not just this year, but over the whole of the next parliament.”

As an illustration of the scale of the funding challenge, looking at current tax levers, the following choices could raise the following income:

- A 1p rise in the Scottish Rate of Income Tax (from the Calman Commission) could see income of £500m per year.

- Raising Council Tax in line with inflation (a real-terms freeze), rather than as currently a freeze in cash-terms, could raise £100m per year by 2020 (in real terms).

- A further increase in Council Tax by 2% (in line with the UK Government’s Social Care precept) could raise around £40m per year;

- A rise in Business Rates by 2% (bringing the poundage to49p (or 50.3p for larger businesses) could be worth around £50m per year.

In addition, the Scotland share of the UK Apprenticeships Levy announced for 2017, and matching the UK Government’s increased stamp duty for buy-to-let homes, announced for the rest of the UK, could see further revenue come to Scotland.

Contact

Russell Gunson – r.gunson@ippr.org 07766 904 332

Danny Wright – d.wright@ippr.org 07887 422 789

Sofie Jenkinson – s.jenkinson@ippr.org 07981 023 031

Lester Holloway – l.holloway@ippr.org 07585 772 633

Notes to Editors

- Protected/non-protected departments in Scotland

The Scottish Government has made a commitment to protect NHS funding in real terms and to pass on all Barnett consequentials from increased NHS spending in England. The Scottish Government has also put a ‘funding floor’ in place for college funding, protecting it in cash terms. Additionally, the Scottish Government has made commitments to build 50,000 affordable homes and provide 1,200 hours of childcare by the end of the parliament. IPPR Scotland also modelled protection of school funding in cash terms per pupil.

- Percentage change in spending in Scotland between 2015/16 and 2019/20 in real-terms and cumulatively

Real terms cumulative % change | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 |

Total Spend | 0.0% | -0.8% | -2.3% | -2.7% | |

Total CDEL | 4.9% | 3.0% | 1.1% | 5.2% | |

Of which | |||||

Affordable housing | 69.3% | 66.3% | 63.2% | 59.9% | |

Non-protected | -3.0% | -4.7% | -6.5% | -1.5% | |

Total Resource | -0.6% | -1.3% | -2.7% | -3.6% | |

Of which | |||||

NHS | 2.3% | 3.6% | 4.1% | 4.6% | |

Childcare | 18.1% | 35.4% | 51.9% | 67.4% | |

Schools | -1.3% | -2.6% | -3.8% | -4.9% | |

Colleges | -1.7% | -3.4% | -5.2% | -7.2% | |

Non-protected | -2.9% | -5.2% | -8.4% | -10.7% |

‘Total Spend’ excludes depreciation and includes projected income from Non-domestic Rates (Business Rates) and capital DEL and capital borrowing (but not financial transactions).

‘Total CDEL’ excludes financial transactions.

‘Total Resource’ excludes depreciation but includes projected income from Non-domestic Rates (Business Rates).

3. The tax and benefit decisions made by the UK Chancellor modelled by IPPR Scotland

National Living Wage: The Chancellor has announced the introduction of a National Living Wage, rising to £9 by 2020/21. Our distributional analysis uses the OBR’s slightly higher estimate for 2020/21, at £9.35.

Income tax: Increase in the tax-free personal allowance to £11,000 next April, and increase in the higher rate threshold, the level after which earnings are taxed at the higher rate, to £43,000, relative to increases in line with consumer price inflation.

Benefit changes: reduction in the benefit cap, four year working-age benefit freeze, cuts to Universal Credit work allowances and restrictions in the family element for new claims/new births

- Distributional impact of George Osborne’s Summer Budget, Autumn Statement and Spending Review income tax and benefit decisions

The distributional impact of household income according to 10 poorest to richest deciles is shown below: