Autumn Statement – Higher rate giveaway is the wrong priority

Autumn Statement – Higher rate giveaway is the wrong priorityArticle

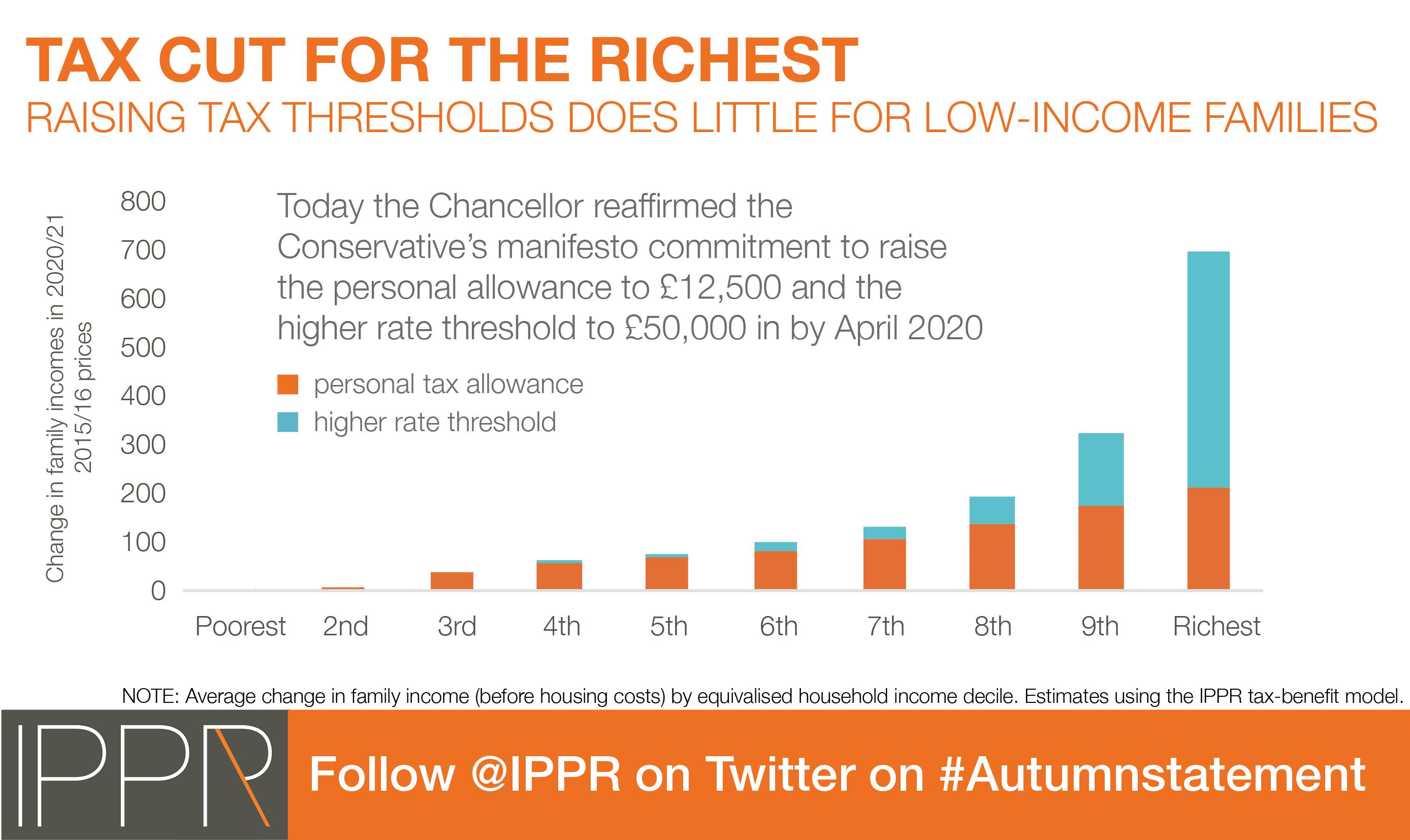

In a brief mention in today’s Autumn Statement the Chancellor confirmed the increase in the personal tax allowance to £12,500 and the threshold for the higher rate to £50,000 by the end of the Parliament.

In fact, it was so brief if you blinked you might have missed it.

This may be because analysis by IPPR shows that the increase in the higher rate threshold primarily helps those already in the richest fifth of society.

At a time when Universal Credit is still being cut by £2 billion per year, and the public finances are facing big challenges because of the Brexit vote, IPPR argues this tax cut for the top is the wrong priority.

Related items

The full-speed economy: Does running a hotter economy benefit workers?

How a slightly hotter economy might be able to boost future growth.

Making the most of it: Unitarisation, hyperlocal democratic renewal and community empowerment

Local government reorganisation need not result in a weakening of democracy at the local level.

Transport and growth: Reforming transport investment for place-based growth

The ability to deliver transformative public transport is not constrained by a lack of ideas, public support or local ambition. It is constrained by the way decisions are taken at the national level.