Autumn Statement – Higher rate giveaway is the wrong priority

Autumn Statement – Higher rate giveaway is the wrong priorityArticle

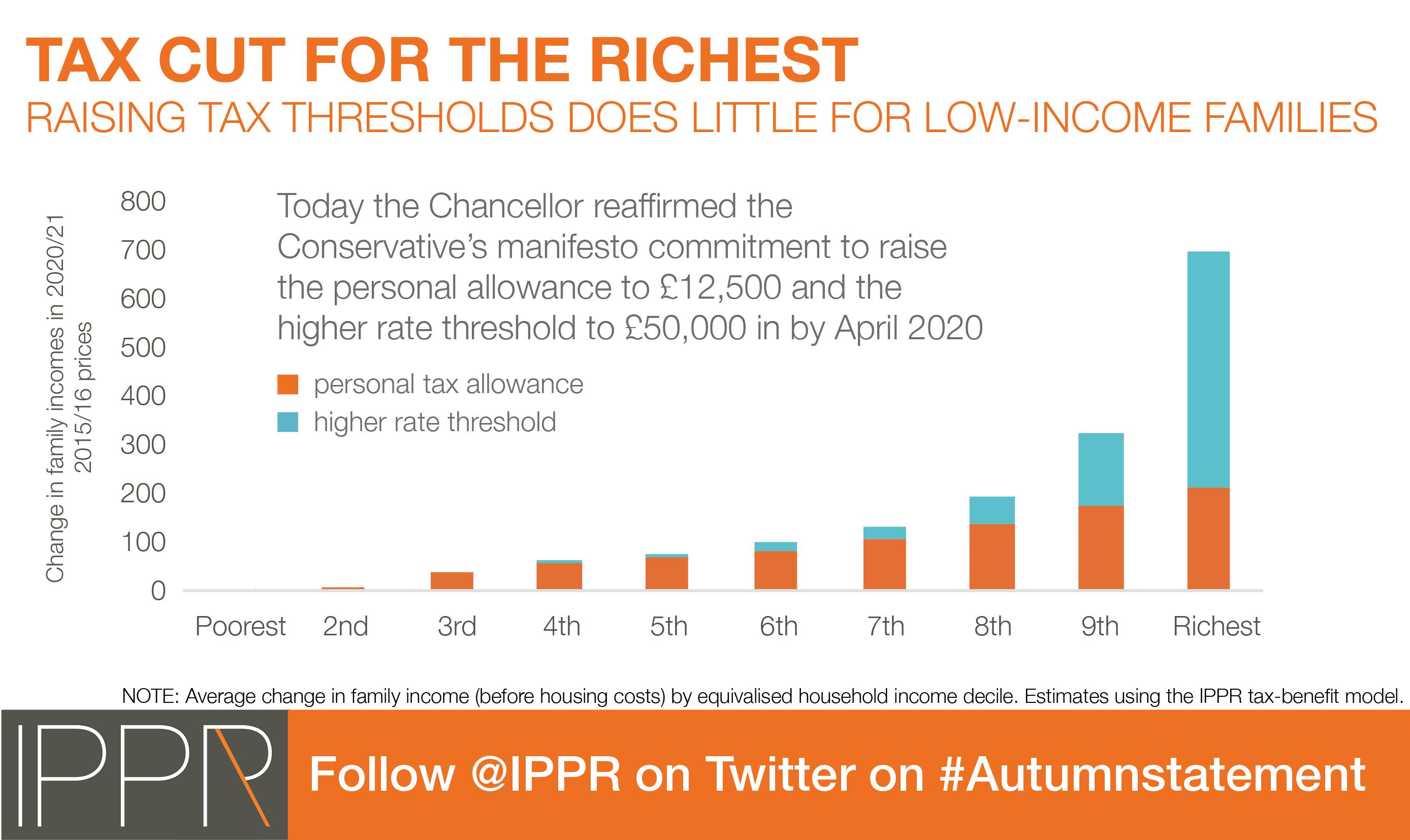

In a brief mention in today’s Autumn Statement the Chancellor confirmed the increase in the personal tax allowance to £12,500 and the threshold for the higher rate to £50,000 by the end of the Parliament.

In fact, it was so brief if you blinked you might have missed it.

This may be because analysis by IPPR shows that the increase in the higher rate threshold primarily helps those already in the richest fifth of society.

At a time when Universal Credit is still being cut by £2 billion per year, and the public finances are facing big challenges because of the Brexit vote, IPPR argues this tax cut for the top is the wrong priority.

Related items

Levelling the playing field: The BBC, Big Tech, and the case for a bold charter

The upcoming charter renewal is the moment to give the BBC the resources, freedom and mission it needs to engage with technology firms on its own terms.

Britain's strategy for a decade of danger: Our nation, our continent, our world

Britain's foreign policy needs a grand strategy that clearly defines the country’s strategy for security, growth and migration.

Will planning reform make housing more affordable?

It is undeniable that housing in England is in crisis.