Health innovation: Breathing life into the northern powerhouse

Article

Health science is one of the four most dynamic and productive sectors in the northern economy. The sector comprises fast-growing, private sector companies in pharmaceuticals, medtech and digital health with strong exports to Europe and beyond, combined with global expertise in clinical and health research led by northern universities and hospitals. These sectors are inextricably linked to public health systems employing over half a million people. Their strengths are brought together in interconnected, place-based clusters that stretch across the North’s geography, from Liverpool’s world leading infectious disease expertise, Manchester and Cheshire’s health technology and pharmaceuticals corridors, through to Leeds’s and Yorkshire’s thriving health technology and advanced manufacturing sector, to the North East’s world-leading hub for ageing, innovation and bio-processing.

However, to maximise the potential of northern health innovation, the government’s new industrial strategy must tackle a number of challenges posed by existing patterns of research funding, the consequences of Brexit, and the ongoing problems of transport connectivity and skills retention. We make three key proposals: a place-based approach to industrial strategy for the health science sector; catch-up capital for research funding; and a series of more local interventions to keep health sciences at the cutting edge of northern productivity.

Key findings

The health science sector is one of the four ‘prime capabilities’ for an industrial strategy in the North of England identified in the 2016 Northern Independent Economic Review (NIER). The NIER found that numerous areas in the North have significant specialisms in subsectors such as pharmaceuticals, life sciences, medical devices and technologies, and wider healthcare services. This report builds on the review in two ways:

- first, it makes a closer investigation into the strengths and specialisms that characterise the health science sector in the North and identifies the precise nature of their productivity potential

- second, it explores how this potential can be nurtured in the context of the new government’s drive for a place-based industrial strategy.

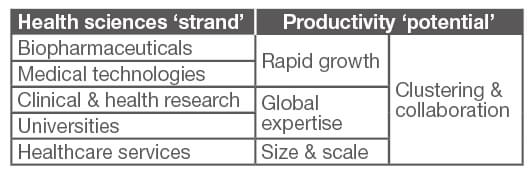

The health science sector can be subdivided into five separate strands of interlinked activity. The North has particular strengths relating to each of these strands, each with its own type of ‘productivity potential’ as illustrated in the below diagram.

The overall potential of the health science sector in the North cannot be captured by exploring the specialisms of its subsectors in isolation. The real strength in northern health sciences lies in its more place-based clusters, their local assets, and the interrelationships between them. These are exemplified in the following clusters.

- Manchester and Cheshire life sciences corridors, which combine the assets in Alderley Park – originally a large AstraZeneca site but now home to over 150 small biotech firms; many spin-offs from the University of Manchester; the Health E-Research Centre (HeRC); the Antimicrobial Resistance Centre; Precision Medicine Catapult Node; Salford Lung Study; and the new Medicines Discovery Catapult.

- This is linked in turn with the Liverpool city-region’s biologics cluster, with the world-renowned Liverpool School of Tropical Medicine and Europe’s largest biologic manufacturing clusters in Speke.

- In the North East, the universities of Newcastle and Durham have developed an international reputation for work on ageing and photonics, while Darlington is host to the Biologics Factory of the Future and the National Biologics Manufacturing Centre.

- In Yorkshire and the Humber there is a strong medtech cluster with key medical equipment, prosthetics and tissue repair manufacturers linked closely with innovation and knowledge hubs at Leeds and Bradford universities; the Advanced Manufacturing Research Centre near Sheffield; and NHS Digital, the NHS Data Spine, bioinformatics and cancer therapeutics specialisms in Leeds.

Challenges

- Despite its many strengths and its huge growth potential, the North of England’s health science sector faces a number of significant challenges.

- Research funding in the UK is heavily skewed towards the so-called ‘golden triangle’: London, the South East and the East of England garner 60.7 per cent of all public and charity funding. This is exacerbated by the fact that the North’s potential is in applied research, for which there is less funding available, and that research excellence needs to be built up over time.

- Exiting the European Union threatens not only the funding that Northern universities receive to support health research but also their ability to attract research expertise from the EU, to be involved in EU-wide research collaborations, and to link into clinical trial and patent regulations where scale can be key to attracting global companies and foreign direct investment.

- The health science sector depends on a good supply of highly skilled workers. Although Northern universities have a strong reputation for producing excellent biomedical and health science graduates, poor east–west transport connectivity undermines the North’s ability to sustain a broad labour pool and attract and retain talent across the North.

Recommendations to central government

- As it develops its new industrial strategy, the government should pay particular attention to the significant strengths of the health science sector in the north of England, beginning by rolling out a science and innovation audit across the whole of the North, and also by establishing better processes for strategic collaboration between government and subnational stakeholders.

- Government should aim to move towards investing 20 per cent of its health science research funding in the North over the next five years – this would match the estimated R&D investment from the private sector, and would enable northern health economies to catch up with those in the golden triangle, or at least compete on a more level playing field.

- Government should ensure northern health science sector interests are explicitly accounted for by the steering committee currently working on the impact of Brexit on the health science sector.

- Government should invest in the northern life science capability that sits within the Department for International Trade, so that the team’s resources on the ground in the UK and abroad in post are in line with those of the UK’s devolved administrations, and reflect the scale of opportunity in this sector and the northern market size. Over time the life sciences sector should spearhead an approach to trade and investment in the North which is equivalent to those of the devolved administrations, and should develop its own special relationship with the North’s key partners abroad – countries such as the US, Japan, Singapore, India and China as well as the growing opportunities from and with the commonwealth.

Recommendations to local and regional stakeholders

- Health service commissioners should develop new approaches to health procurement to maximise regional clusters and supply chains and drive up local economic multipliers. They should pull through research into practice more efficiently to maximise healthcare gains.

- Local enterprise partnerships and growth hubs should support health science startups and match-fund ‘corporate accelerator’ partnerships between big UK and multinational firms and universities.

- Local transport authorities – working closely with Transport for the North – should develop strategic transport plans around health service and complementary tech clusters, and support initiatives to broaden intercity connections to expand the highly skilled northern labour pool.

Related items

The full-speed economy: Does running a hotter economy benefit workers?

How a slightly hotter economy might be able to boost future growth.

Making the most of it: Unitarisation, hyperlocal democratic renewal and community empowerment

Local government reorganisation need not result in a weakening of democracy at the local level.

Transport and growth: Reforming transport investment for place-based growth

The ability to deliver transformative public transport is not constrained by a lack of ideas, public support or local ambition. It is constrained by the way decisions are taken at the national level.