The true cost of energy: How competition and efficiency in the energy supply market impact on consumers' bills

Article

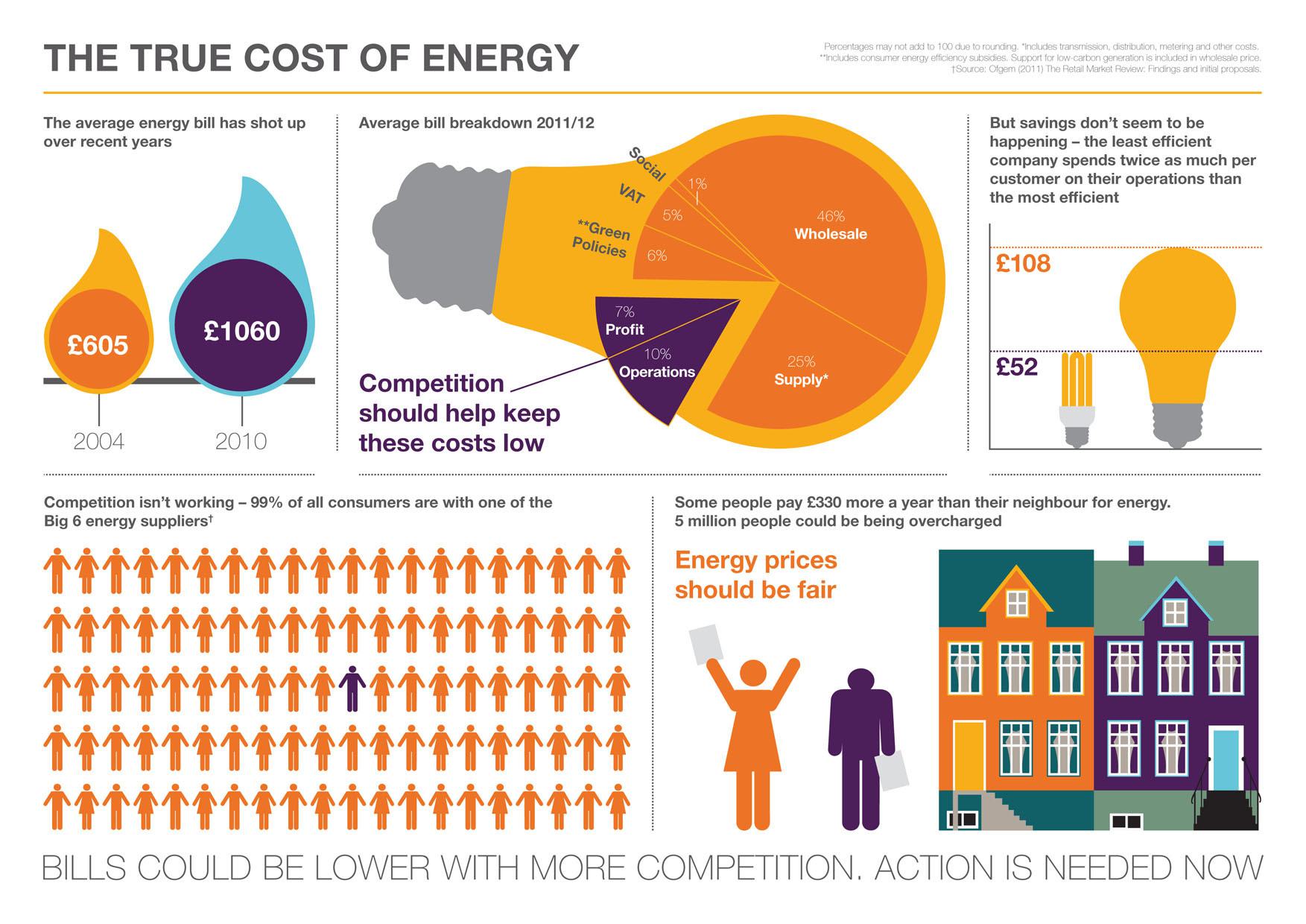

This report sets out to establish what impact a lack of competition in the energy supply market is having on consumers' energy bills. We conclude that there is a lack of competition in the energy supply market and that some consumers are paying over the odds as a result.

There is a need for greater fairness in terms of costs charged to energy consumers. People cannot choose to 'opt out' of buying energy. Regulation of the supply market must aim to produce beneficial outcomes for the majority of consumers and not simply those that are most active, particularly at a time of high unemployment and when incomes are squeezed.

We put forward recommendations for increasing competition in the energy supply market and exerting downward pressure on energy prices.

Some of our key findings are:

- Contrary to what we would expect from a competitive market, operational costs per customer account across suppliers have diverged since 2007: that is, the gap between the most and least efficient provider in terms of operational costs has gotten wider.

- Costs to suppliers of delivering environmental and social policies may be as much as £9 per customer per year less than Ofgem has reported.

- Taking a moderate view of the effect of increased competition on household energy prices, we estimate average potential savings of £70 per year by 2020. This is equivalent to the costs to consumers of the electricity market reform, the carbon price floor, the feed-in tariff (FIT), the warm home discount and most of the renewables obligation combined.

The report's core argument is summarised in the following infographic (click to enlarge or download as PDF):

Related items

The full-speed economy: Does running a hotter economy benefit workers?

How a slightly hotter economy might be able to boost future growth.

Making the most of it: Unitarisation, hyperlocal democratic renewal and community empowerment

Local government reorganisation need not result in a weakening of democracy at the local level.

Transport and growth: Reforming transport investment for place-based growth

The ability to deliver transformative public transport is not constrained by a lack of ideas, public support or local ambition. It is constrained by the way decisions are taken at the national level.