Chancellor’s first step to raising tax on income from wealth leaves potential £50 billion untapped, IPPR finds

Article

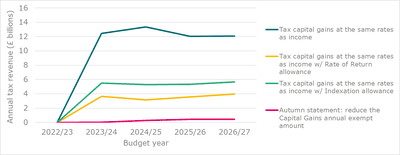

- Autumn statement reforms to capital gains tax raise just hundreds of millions of tax revenue, dwarfed by the tens of billions left untaxed

- Fair reforms to equalise taxes on income from wealth with income from work would help avoid unnecessary spending cuts

New analysis of capital gains tax by IPPR shows that fair reforms to the tax, that would ensure income from wealth and work are taxed at the same rate, would raise £50bn of tax revenue over the next four years.

In his autumn statement, the chancellor reduced the annual exempt allowance on capital gains from £12,300 to £6,000 in 2023, then £3,000 in 2024.

Yet the chancellor’s reform is forecast to raise just £435 million in 2026/7, dwarfed by the £12 billion that could be raised in the same period if the government embraced taxing capital gains at the same rate as the income tax schedule.

Capital gains tax, paid on the proceeds from selling an asset (such as stocks, bonds, and property) for more than its purchase price, is currently levied at a lower rate than income tax. This means that people who derive their income from existing wealth are taxed at a lower rate than people who work. This is unfair and IPPR propose that a fair system would tax all income at the same rate.

Our analysis of a fairer tax on capital gains shows:

- Taxing capital gains at the same rate as the income schedule could raise £50bn over the next four years

- Including an allowance for inflation, revenue falls to £22bn over the same period, whilst adjusting for “a rate of return allowance” would still bring in £14bn

In 1988 under conservative Chancellor Nigel Lawson, capital gains moved to being taxed at income tax rates.

IPPR also back other tax proposals that will make the UK tax system fairer and raise more revenue to further offset damaging spending cuts:

- Extending national insurance contributions to all investment income and pension-age individuals would raise £12 billion per year

- Abolishing non-dom tax status would raise £3 billion per year

- Taxing ‘share buybacks’ or transfers of corporate profits to shareholders would raise £225 million per year

- Replacing inheritance tax with a lifetime gifts tax would raise £9 billion per year

Dr George Dibb, head of the Centre for Economic Justice at IPPR, said:

“The chancellor chose stealth taxes over wealth taxes. He was right to look at capital gains tax but wrong to only tweak around the edges. The reforms he announced today will still leave those who earn income from wealth paying lower tax rates than working people. Not only that, he’s leaving tens of billions of pounds on the table and untaxed. This fair reform would help avoid unnecessary cuts to public spending.

“The Treasury’s own autumn statement documents says, “a fair tax system also ensures that individuals doing similar work pay a similar amount of tax” but then concedes that “that those with unearned income also contribute”. Simply contributing is not enough – those who draw unearned income from wealth should pay the same tax as working people.”

ENDS

Dr George Dibb, head of the centre for economic justice at IPPR is available for interview.

CONTACT

Liam Evans, Senior Digital and Media Officer: 07419 365334 l.evans@ippr.org

NOTES TO EDITORS

- IPPR is the UK’s pre-eminent progressive think tank. With more than 40 staff in offices in London, Manchester, Newcastle and Edinburgh, IPPR is Britain’s only national think tank with a truly national presence. http://www.ippr.org/

- Our full proposals for reforms to capital gains tax are set out in the report ‘Just tax: Reforming the taxation of income from wealth and work’

- Capital gains tax is a tax on the profit when you sell (or 'dispose of') something (an 'asset') that's increased in value. The tax is levied on the gain or increase in value, not the total value. For example, capital gains is payable on the sale of stocks and shares, second homes, and business assets.

- Capital gains tax is lower than income tax for the same value meaning income from wealth is taxed lower than income from work. Basic rate taxpayers pay income tax of 20% but capital gains tax of 10% (or 18% on residential property). Higher rate taxpayers pay income tax of 40% but capital gains of 20% (or 28% on residential property).

- The analysis uses published HMRC data on capital gains broken down by income brackets to estimate the likely percentage growth in CGT revenue from equalising the tax bands had it happened in 2020/21. This growth factor is then applied to the latest OBR forecast for capital gains tax revenue over time. A behavioural multiplier is then applied, derived from previous HMRC estimates from previous increases to CGT rates, which reduce our revenue estimates by a fifth across the period. Our methodology is set out in full here: Just tax: Reforming the taxation of income from wealth and work

- We have combined data on asset disposals by duration with data on bond yields and inflation over time to estimate the proportion of gains which would remain taxable under both allowances. A more detailed explanation can be found in the Just Tax report. We assume additionally that behavioural effects reduce revenue lost from these allowances, also by a fifth.

| All figures £bn | 2023/24 | 2024/25 | 2025/26 | 2026/27 | Total |

|---|---|---|---|---|---|

| Additional forecasted revenue by aligning CGT rates with income tax rates | 12 | 13 | 12 | 12 | 50 |

| Additional revenue if aligning rates and introducing rate of return allowance | 4 | 3 | 4 | 4 | 14 |

| Additional revenue if aligning rates and introducing indexation allowance | 5 | 5 | 5 | 6 | 22 |

- Revenue projections for rates equalisation presented here will very slightly underestimate potential revenue as they do not include the changes to the additional rate tax threshold introduced in the autumn statement or planned reductions in the annual exempt amount.

Related items

Will technology reduce the cost of delivering public services?

This is the third in a series of blogs related to IPPR Scotland’s project on ‘Employment, Productivity and Reform in the Scottish Public Sector’ funded by the Robertson Trust.

The full-speed economy: Does running a hotter economy benefit workers?

How a slightly hotter economy might be able to boost future growth.

Making the most of it: Unitarisation, hyperlocal democratic renewal and community empowerment

Local government reorganisation need not result in a weakening of democracy at the local level.