Poverty doesn’t have to be inevitable – it needs political will and investment to eradicate

Article

In amongst the political intrigue of last week’s SNP leadership election outcome, one pressing issue ran the risk of being overlooked – the damning revelation that a quarter of a million children are living in poverty in Scotland, an issue our new first minister now inherits.

In a country like Scotland those figures should be a stark wake-up call to all. So how can it be that progress to cut child poverty has stagnated, and that we are barely making a dent in the seemingly ever-growing rate?

Ambitious commitments to reduce child poverty must be translated into policy delivery

The Scottish government has taken important steps to make child poverty a priority, including setting legally binding targets to reduce it. However, while legislation is important and can focus minds, targets almost a decade away mean little when one in four children are trapped in poverty today.

Scotland has taken important steps to tackle poverty in recent years and shown what can be possible with political will and investment – including the introduction of, and successive increases to, the Scottish Child Payment which – now it has been fully rolled out – will have a greater impact on child poverty. But the current levels of child poverty must act as a wake-up call: we must go further, faster with all the tools at our disposal.

That’s why it was really welcome to see Humza Yousaf make tackling child poverty a central plank of his pitch to be SNP leader – and ultimately, first minister – with a range of ambitious commitments. Now must be the time for us to see these translated into equally ambitious delivery.

During the SNP leadership election, Yousaf pledged to create an additional band of income tax on earnings between £43,662 and £125,140 – stating revenue raised should be used to fund increases to the £25 a week Scottish Child Payment. While social security alone won’t be able to do all the heavy lifting needed to meet our final child poverty targets in 2030, it can do more to get us to the interim targets in the coming year.

Given this, we decided to analyse what impact a new income tax band could have for meeting our child poverty targets – and crucially, helping to give children in Scotland a fair start in life.

Impact of increases to Scottish Child Payment on child poverty levels

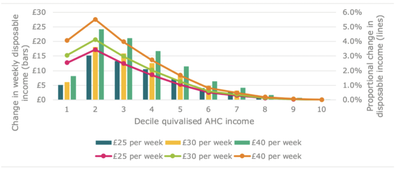

Our modelling suggests increasing the Scottish Child payment from £25, to £30 per week, per eligible child could take a percentage point off the poverty rate. That means lifting around 10,000 children out of poverty, at an investment of £87 million. But could we do even more?

We found that going further and increasing the Scottish Child Payment to £40 per week – as called for by a range of child poverty charities – could lift 20,000 children out of poverty. This would require an investment of £261 million.

Importantly, this would come over and above the already 40,000 children expected to be lifted out by the existing £25 payment. As would be expected, that’s an incredibly progressive way to get money into people’s pockets – shown in figure 1.

Figure 1: Change in weekly disposable income by weekly level of Scottish Child Payment

With the potential to lift 60,000 out of poverty, that would get us beyond the interim target and on a positive path to our final targets – but getting there will still require going further, faster on more fundamental reform – not least the government’s commitment to develop a new minimum income guarantee.

But increasing the payment is only one side of the equation – we also need to think about how it could be funded.

Funding increases through a new progressive income tax band

Government is about choices – if you commit yourself to meting child poverty targets then you need to meet them - whatever it takes. That means looking at spending, but it also means taking a more progressive approach to tax.

That’s an area where the Scottish government has taken a good approach to date. This year in Scotland, income will be taxed at 42 per cent between £43,663 and £125,140, and 47 per cent on income above £125,140. Following from Yousaf’s leadership pledge to introduce a new income tax band, we decided to look at what could be done between those points.

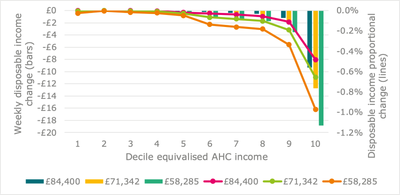

We found introducing a new rate of 45 per cent at the mid-point between the current rates – on income between £84,400 and £125,140 – would raise an additional £110 million. More than enough to fund a further £5 a week for the Scottish Child Payment.

Going further and introducing a 45 per cent income tax rate on earnings above £58,285 – earnings that would put someone in the 90th percentile for full-time gross earnings in Scotland – could raise an additional £257 million. That’s almost enough for a £40 a week payment.

Again, in both instances, the effect would be highly progressive – shown in figure 2.

Figure 2: Absolute and proportional change in income across various three new tax band scenarios

More fundamental progressive reform to taxation is needed long-term

While devolved tax represents a significant lever, under current policy its revenue (excluding council tax and non-domestic rates) still only accounts for around a third of total Scottish government resource funding. The total revenue generated, and the offsetting impacts of the block grant adjustment, are driven by a range of factors - including the relative growth in earnings in Scotland compared to the rest of the UK, and the profile of Scottish taxpayers. So, the results could be variable – but they show not just what might be possible, but also further underline the need for more fundamental reform.

As we have called for through previous research, alternative revenue raising options must be explored to deliver on the big policy priorities for Scotland. This again is an area where Humza Yousaf has made some early and encouraging signals – including his willingness to explore things like wealth taxes.

The Scotland Act 1998 devolved wide powers around local taxation to fund local authority expenditure. In the absence of other limiting statutes, this means that the Scottish parliament could, in theory, introduce a broad range of new forms of taxation, if the revenue is used to fund local authority spending. In turn this could free up resource currently used for local government grants for other means.

Importantly, this could start to address the vast disparities in wealth we see in Scotland - and open further opportunities to raise the necessary revenue to fully deliver on the government’s stated priorities to creative a truly progressive Scotland where all have equal opportunity to thrive.

We’ve set out some of our thinking on what that could look like in the past and will be undertaking further research in the months ahead. But the core message is clear: the opportunity to take more radical action is there - now we need to see the political will to deliver it.

Philip Whyte is the director of IPPR Scotland. He tweets at @Philip_Whyte.

Related items

The full-speed economy: Does running a hotter economy benefit workers?

How a slightly hotter economy might be able to boost future growth.

Making the most of it: Unitarisation, hyperlocal democratic renewal and community empowerment

Local government reorganisation need not result in a weakening of democracy at the local level.

Transport and growth: Reforming transport investment for place-based growth

The ability to deliver transformative public transport is not constrained by a lack of ideas, public support or local ambition. It is constrained by the way decisions are taken at the national level.