Autumn Statement – Higher rate giveaway is the wrong priority

Autumn Statement – Higher rate giveaway is the wrong priorityArticle

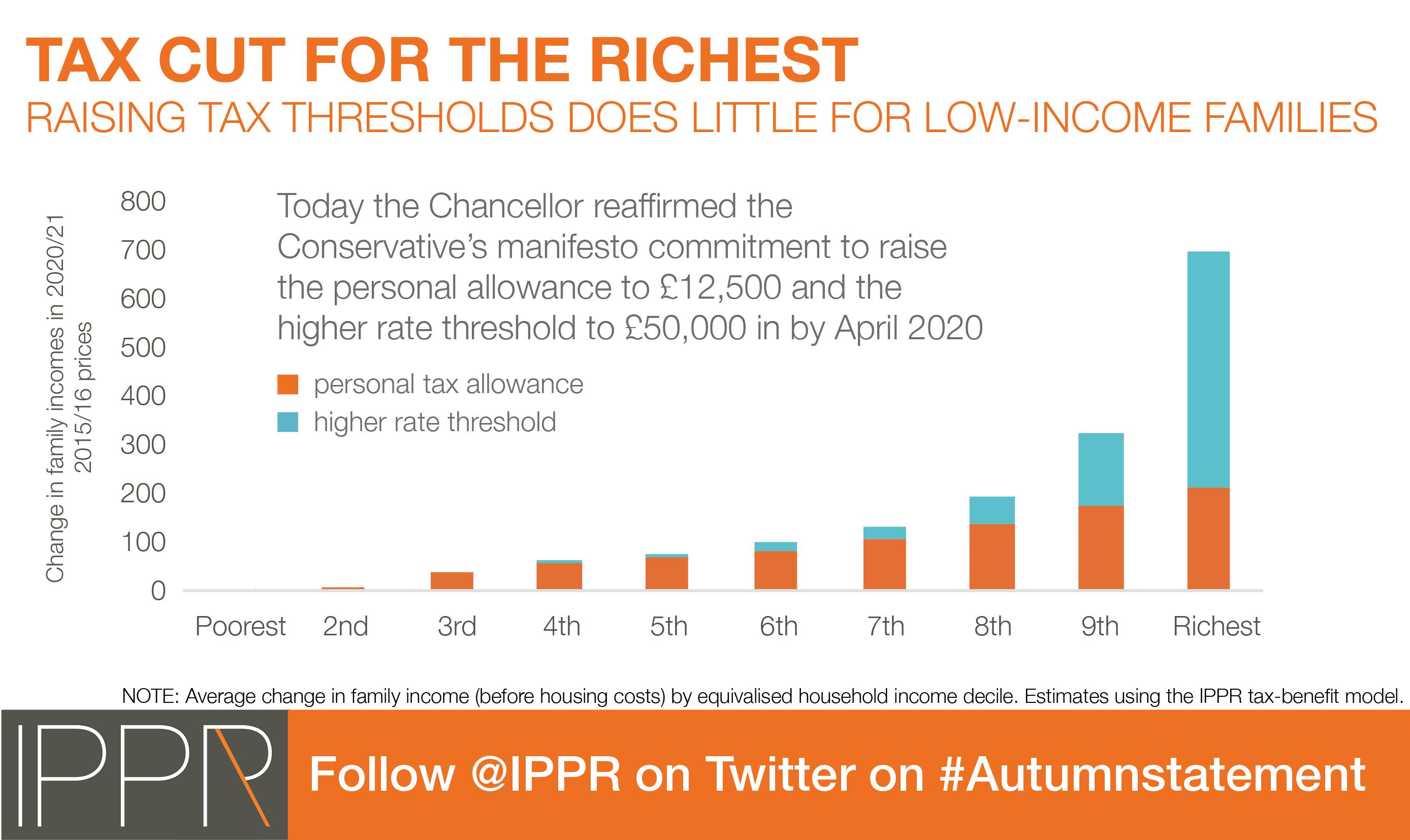

In a brief mention in today’s Autumn Statement the Chancellor confirmed the increase in the personal tax allowance to £12,500 and the threshold for the higher rate to £50,000 by the end of the Parliament.

In fact, it was so brief if you blinked you might have missed it.

This may be because analysis by IPPR shows that the increase in the higher rate threshold primarily helps those already in the richest fifth of society.

At a time when Universal Credit is still being cut by £2 billion per year, and the public finances are facing big challenges because of the Brexit vote, IPPR argues this tax cut for the top is the wrong priority.

Related items

Reclaiming Britain: The nation against ethno-nationalism

How can progressives respond to the increasing ethnonationalist narratives of the political right?

Rule of the market: How to lower UK borrowing costs

The UK is paying a premium on its borrowing costs that ‘economic fundamentals’, such as the sustainability of its public finances, cannot fully explain.

Restoring security: Understanding the effects of removing the two-child limit across the UK

The government’s decision to lift the two-child limit marks one of the most significant changes to the social security system in a decade.